Deckers Steps into New Era with Record Earnings and Leadership Shuffle

Deckers Outdoor Corporation (DECK) dropped its 8-K filing on May 22, 2025, and it’s packed with more than just numbers. Let’s unpack the key takeaways from this latest batch of official documents.

The 8-K form itself officially announced the company’s Q1 2025 and fiscal year 2025 financial results. But the big news? A changing of the guard at the top. Cynthia L. Davis is stepping into the role of Board Chair, replacing the retiring Michael F. Devine, III. Victor Luis also takes on a new role as Chair of the Talent & Compensation Committee. The board also shrunk down by one member, now at a lean ten.

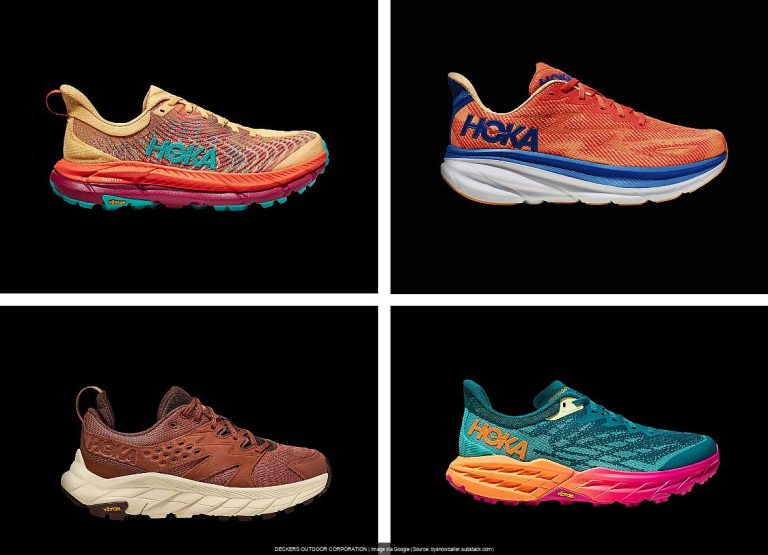

The EX-99.1 Press Release painted a rosy picture of FY2025. Deckers reported record revenue of $4.99 billion (up 16%) and diluted EPS of $6.33 (a 30% jump!). ✅ HOKA and UGG brands continue to be the stars of the show, growing at 24% and 13% respectively. The company seems pretty confident about the future, boosting its share repurchase authorization to a cool $2.5 billion. ✅ However, they did acknowledge some “greater near-term uncertainty” in the global trade environment. ⚠️

Deckers delivered another exceptional year of results in fiscal 2025, highlighted by the HOKA and UGG brands’ respective revenue growth.

The EX-99.2 Press Release focused on the leadership transition, confirming the appointments of Davis and Luis and emphasizing Davis’s experience. ✅ They’re clearly banking on her expertise to guide the company’s continued growth.

Deckers has become an industry leader…positioned us for continued growth and top-tier levels of profitability.

The Analyst’s Crystal Ball: DECKERS OUTDOOR CORPORATION (DECK) – What Now? (Updated May 22, 2025) 🔮

Sentiment Score from latest documents (this batch only): 75/100 (raw avg: 0.50)

Implication of Current Filings: Positive Momentum Building

Overall Outlook & Forecast

This latest batch of filings from Deckers paints a picture of a company firing on all cylinders, with record financial performance and a strategic leadership transition. While global trade uncertainties loom, the strong results and increased share repurchase authorization suggest a positive outlook for the next 1-2 years.

What Would Make Us Yell “To The Moon!” (Go Long) 🚀

- Continued strong performance of HOKA and UGG brands, exceeding growth expectations.

- Successful navigation of global trade uncertainties, maintaining profitability.

- Innovative product launches and expansion into new markets.

When We’d Hit The Eject Button (Go Short) 📉

- Significant slowdown in HOKA and UGG sales growth, indicating market saturation or changing consumer preferences.

- Negative impact from global trade uncertainties leading to decreased profitability.

- Failure of new leadership to effectively execute the company’s growth strategy.

The Mic Drop: So, What’s the Deal with DECKERS OUTDOOR CORPORATION’s Latest Paper Trail?

Deckers latest filing reveals a company at a pivotal moment. Record earnings are great, but new leadership always brings both opportunity and risk. This is definitely one to watch. As always, this isn’t financial advice, so do your own research before making any investment decisions.

Possible Google Searches After This 8-K From DECKERS OUTDOOR CORPORATION (DECK)

- DECK stock forecast

- Deckers Outdoor Corporation Q1 2025 earnings

- Cynthia Davis Deckers Board Chair

- Deckers share repurchase program

- HOKA brand growth 2025

- UGG sales figures

- Deckers global trade impact

- DECK stock buy or sell

- Deckers leadership changes

- Victor Luis Deckers

- Deckers Board of Directors

- Future of Deckers brands

- Deckers investor relations

- DECK stock analysis

- Deckers financial outlook

P.S. The SEC saga never ends! As DECKERS OUTDOOR CORPORATION files more, this analysis will evolve. Current as of May 22, 2025.