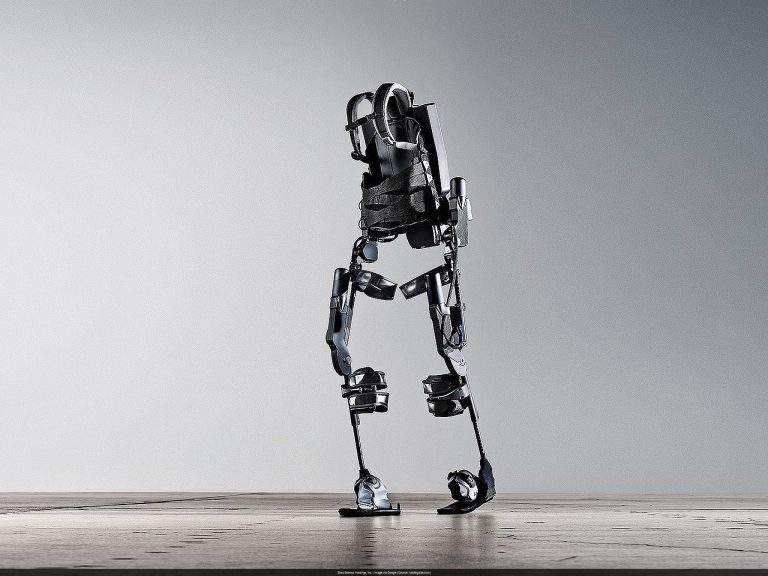

Ekso Bionics Stock Split Delayed (Again!): What’s the Deal?

Ekso Bionics Holdings, Inc. (EKSO) filed an interesting 8-K on May 21, 2025, and we’re here to decode it for you. Buckle up, because navigating SEC filings can be like trying to assemble IKEA furniture without the instructions… but way less satisfying.

The main 8-K form detailed the results of EKSO’s 2025 Annual Meeting of Stockholders. Shareholders voted on a number of things, but the big news? They approved a 1-for-15 reverse stock split. 🚩 This is usually a sign a company is struggling to keep its stock price above the minimum required for listing on an exchange like Nasdaq. The primary purpose of the Reverse Stock Split is to help the Company maintain the listing of its common stock on The Nasdaq Capital Market.

Ouch.

The EX-99.1 Press Release accompanying the initial 8-K confirmed the split, set to take effect May 27, 2025. No fractional shares, folks – they’ll be rounded up. This move impacts all outstanding shares, options, warrants, and restricted stock units.

But wait, there’s more! A second 8-K filing announced a slight delay – the split’s effective date is now June 2, 2025. This filing also revealed that EKSO expects to have approximately 2.4 million shares outstanding after the split.

And because apparently one delay wasn’t enough, a third communication, another EX-99.1 Press Release, reiterated the new June 2nd effective date. They really want to make sure we know about this delay, huh?

EKSO shareholders approved a 1-for-15 reverse stock split, a move aimed at boosting the company’s flagging share price and maintaining its Nasdaq listing.

The effective date of the reverse stock split has been pushed back twice, now landing on June 2, 2025.

After the split, EKSO anticipates approximately 2.4 million shares outstanding.

The Analyst’s Crystal Ball: Ekso Bionics Holdings, Inc. (EKSO) – What Now? (Updated May 22, 2025) 🔮

Sentiment Score from latest documents (this batch only): 32/100 (raw avg: -0.35)

Implication of Current Filings: Headwinds Increasing

Overall Outlook & Forecast

This latest batch of filings doesn’t paint a rosy picture for EKSO. While the reverse stock split itself is a maneuver to regain compliance, it doesn’t address the underlying issues contributing to the low stock price. This reinforces a negative outlook for the near term, at least for the next 6-12 months. Investors should proceed with caution.

What Would Make Us Yell “To The Moon!” (Go Long) 🚀

- Unexpectedly strong sales figures and revenue growth demonstrating a turnaround in the company’s core business.

- A significant partnership or acquisition that infuses the company with much-needed capital or expands its market reach.

- Positive clinical trial results or regulatory approvals for new products that could significantly boost investor confidence.

When We’d Hit The Eject Button (Go Short) 📉

- Further declines in revenue and increasing losses, suggesting the company’s financial situation is worsening.

- Delisting from Nasdaq due to continued inability to meet listing requirements, even after the reverse split.

- Announcements of further dilutions or restructuring that could negatively impact shareholder value.

The Mic Drop: So, What’s the Deal with Ekso Bionics Holdings, Inc.’s Latest Paper Trail?

These filings scream “trouble in paradise” for EKSO. While the company is trying to stay afloat with this reverse stock split, it’s a band-aid on a potentially larger wound. This isn’t a sudden shift, but rather a continuation of a concerning trend. Remember, this isn’t financial advice, so do your own research (DYOR) before making any investment decisions.

Possible Google Searches After This 8-K From Ekso Bionics Holdings, Inc. (EKSO)

- EKSO reverse stock split 2025

- Why is EKSO stock splitting?

- EKSO stock price after reverse split

- Ekso Bionics Nasdaq delisting risk

- EKSO stock forecast

- Ekso Bionics financial outlook

- Impact of reverse stock split on EKSO shareholders

- EKSO stock news

- EKSO SEC filings

- Ekso Bionics investor relations

- EKSO stock buy or sell

- What does EKSO’s reverse split mean for investors?

- Will EKSO be delisted from Nasdaq?

- Is EKSO stock a good investment?

- EKSO stock analysis

P.S. The SEC saga never ends! As Ekso Bionics Holdings, Inc. files more, this analysis will evolve. Current as of May 22, 2025.