V.F. Corporation’s 10-K: Reinventing the Wheel While the Wagon Burns?

V.F. Corporation (VFC) filed its 10-K on May 22, 2025, and let’s just say it’s a mixed bag. We’re going to unpack the key documents and see what story they tell about the future of this apparel giant.

The initial 8-K simply announced the release of VFC’s Q4 and full-year fiscal 2025 results and declared a $0.09 quarterly dividend. So far, so good, right?

Then, the EX-99.1 earnings presentation offered a bit more color. While Q4 revenue was in line with guidance, adjusted operating income actually *exceeded* expectations, thanks to cost savings from their “Reinvent” transformation program (green flag!). They also significantly reduced their debt. However, the company offered a rather gloomy Q1 2026 guidance, projecting declining revenue and an operating loss.

Debt down, operating income up – but future projections are less rosy. Is this a turnaround or a temporary reprieve?

But here’s where things get interesting (and by interesting, I mean concerning). A separate 8-K revealed an amendment to VFC’s revolving credit facility, requiring them to put up more collateral (red flag!). The EX-10.1 provided the gory details, revealing it’s the *fifth* such amendment. This suggests lenders are getting nervous.

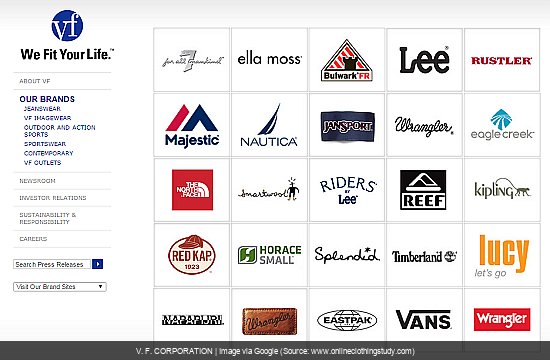

The 10-K itself didn’t exactly paint a prettier picture. It confirmed the sale of the Supreme brand (which helped pay down debt, but still…). More worryingly, it revealed significant impairment charges for the Dickies and Icebreaker brands, alongside declining overall revenues (double red flag!). VF recorded impairment charges of $51.0 million to write down the Dickies indefinite-lived trademark intangible asset to its estimated fair value.

Ouch.

Impairment charges and declining revenues – are those tumbleweeds I see blowing through VFC’s balance sheet?

And as if that weren’t enough, the EX-4.17 revealed even *more* debt than previously disclosed. While the “Reinvent” program and “The VF Way” offer a glimmer of hope, the overall financial picture looks…well, let’s just say challenging.

The Analyst’s Crystal Ball: V. F. CORPORATION (VFC) – What Now? (Updated May 22, 2025) 🔮

Sentiment Score from latest documents (this batch only): 43/100 (raw avg: -0.13)

Implication of Current Filings: Headwinds Increasing

Overall Outlook & Forecast

Despite some positive signs from cost-cutting measures and debt reduction, the overall picture painted by this 10-K filing is concerning. Declining revenues, significant impairment charges, and increasing lender caution suggest V.F. Corporation faces significant challenges. While the “Reinvent” program offers a potential path forward, its success remains uncertain. This points towards a cautious outlook, bordering on negative, for at least the next year.

What Would Make Us Yell “To The Moon!” (Go Long) 🚀

- A sustained reversal in revenue trends, demonstrating the effectiveness of the “Reinvent” program.

- Successful integration of “The VF Way” operating principles leading to improved profitability.

- Stabilization of brand value and a reduction in impairment charges.

When We’d Hit The Eject Button (Go Short) 📉

- Further amendments to the credit facility indicating increased lender concern and potential financial distress.

- Continued decline in revenues and profitability despite cost-cutting measures.

- Additional impairment charges or divestitures suggesting further erosion of brand value.

The Mic Drop: So, What’s the Deal with V. F. CORPORATION’s Latest Paper Trail?

V.F. Corporation’s latest 10-K reveals a company grappling with serious challenges. While there are glimmers of hope in their cost-cutting efforts and turnaround plan, the overall financial picture is far from rosy. This filing marks a decidedly negative turn in their narrative, raising serious questions about their future prospects. As always, this isn’t financial advice, so do your own research before making any investment decisions.

Possible Google Searches After This 10-K From V. F. CORPORATION (VFC)

- VFC 10-K 2025 summary

- V.F. Corporation financial troubles

- Is VFC stock a good buy?

- VFC “Reinvent” program success

- VFC brand impairment charges

- Impact of Supreme sale on VFC

- VFC debt levels and credit facility

- VFC Q1 2026 guidance

- VFC future outlook and forecast

- The VF Way operating principles

- VFC stock analysis

- VFC competitors

- VFC dividend safety

- VFC management changes

- VFC long-term strategy

P.S. The SEC saga never ends! As V. F. CORPORATION files more, this analysis will evolve. Current as of May 22, 2025.