Kohl’s Latest 8-K: Good News, Bad News, and 10% Interest Rates?! (May 30, 2025)

Welcome back to the ongoing saga of Kohl’s, dear readers! This is the place to be for all things KSS SEC filings, and trust me, it’s more thrilling than it sounds (sometimes). We’ve been diligently chronicling their turnaround journey, and the latest 8-K filing from May 30, 2025, adds a particularly interesting twist. Buckle up, because this rollercoaster just took a sharp turn.

As you might recall from our previous installments (here, here, and here), Kohl’s Q1 2025 earnings hinted at a potential comeback story. Sales were down, but profitability was looking up. So what’s the latest? Well, let’s just say things got…complicated.

Kohl’s just took out a $360 million loan with a 10% interest rate. Ten. Percent. That’s…not great, Bob.

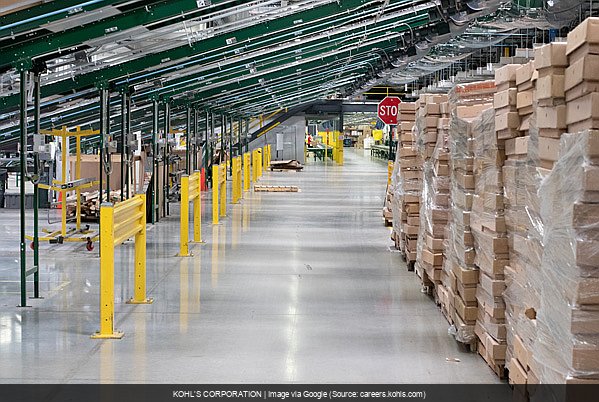

The 8-K filing itself lays out the details: Kohl’s issued $360 million of 10% senior secured notes due 2030. 🚩 While they’re using the cash to pay off existing debt (which, okay, fine), that interest rate is screaming “desperation.” It kind of throws a wet blanket on the whole “turnaround” narrative, doesn’t it? And then there’s the EX-99.1, which helpfully adds that these notes are secured by liens on 11 distribution centers. 🚩 So, yeah, if things go south, those warehouses are the first things on the chopping block. Not exactly inspiring confidence.

This isn’t just refinancing; it’s refinancing with a hefty price tag and some serious strings attached.

And the fine print? Oh, the fine print. The EX-99.1 also reveals some fun little restrictive covenants. 🚩 Kohl’s is now limited in what assets it can sell, what liens it can place, and even what payments it can make. Talk about tying your hands! This puts a serious damper on their ability to maneuver and potentially throws a wrench in any grand turnaround plans they might have cooked up.

The Analyst’s Crystal Ball: KOHL’S CORPORATION (KSS) – What Now? (Updated May 30, 2025) 🔮

Sentiment Score from latest documents (this batch only): 20/100 (raw avg: -0.60)

Implication of Current Filings: Concerning Developments

Overall Outlook & Forecast

This 8-K throws a major curveball into Kohl’s narrative. While the Q1 earnings showed some glimmers of hope, this high-interest debt and the accompanying restrictions raise serious concerns about their long-term financial health and ability to execute their turnaround strategy. It’s like they took two steps forward and then tripped over a pile of 10% interest rate debt.

What Would Make Us Yell “To The Moon!” (Go Long) 🚀

- A significant and sustained increase in sales, demonstrating that their turnaround efforts are gaining real traction.

- Early repayment of a portion of the high-interest debt, signaling improved financial stability.

- A strategic partnership or acquisition that significantly strengthens their market position.

When We’d Hit The Eject Button (Go Short) 📉

- Further declines in sales, suggesting that the turnaround plan is failing.

- Difficulty meeting the terms of the new debt agreement, potentially leading to default or further asset sales.

- Downgrades by credit rating agencies, reflecting increased risk.

The Mic Drop: So, What’s the Deal with KOHL’S CORPORATION’s Latest Paper Trail?

Kohl’s latest filing isn’t just another boring document; it’s a potential game-changer. This 10% debt bomb raises serious questions about their future. While the Q1 results offered a glimmer of hope, this latest move suggests the turnaround might be more of a tightrope walk. As always, do your own research (DYOR) and stay tuned for more updates as this story unfolds.

Key Questions Answered by This 8-K From KOHL’S CORPORATION (KSS)

-

Why did Kohl’s issue new debt?

Kohl’s issued $360 million in 10% senior secured notes due 2030 to repay existing debt, particularly borrowings under its revolving credit facility and upcoming 4.25% notes due 2025.

-

What are the concerns about this new debt?

The high 10% interest rate suggests a higher cost of borrowing and potential financial strain, while the secured nature of the debt, backed by liens on 11 distribution centers, adds further risk.

-

What are the restrictive covenants associated with the new debt?

The indenture for the new notes includes restrictive covenants that limit Kohl’s flexibility regarding asset dispositions, additional liens, and certain payments.

-

How does this debt issuance impact Kohl’s turnaround efforts?

The high interest payments and restrictive covenants could hinder Kohl’s ability to invest in and execute its turnaround strategy, potentially offsetting the positive momentum from Q1 2025 earnings.

-

What assets secure the new debt?

The debt is secured by liens on 11 distribution centers owned by Kohl’s Real Estate Holdings, LLC and its subsidiaries.

-

What is the maturity date of the new notes?

The new senior secured notes are due in 2030.

-

Where can I find the official details of this debt issuance?

The details are available in the 8-K filing and the EX-99.1 document filed with the SEC on May 30, 2025.

P.S. The SEC saga never ends! As KOHL’S CORPORATION files more, this analysis will evolve. Current as of May 30, 2025.