Novagold Ditches Barrick, Shacks Up with Paulson: Donlin Gold Gets a Makeover (and a Billion Dollars) 💰

Welcome back to the ongoing saga of Novagold Resources Inc. (NG), where we’ve been diligently chronicling every twist and turn of their SEC filings like dedicated librarians of financial arcana. This installment covers the June 3rd, 2025 8-K, and let me tell you, it’s a real page-turner.

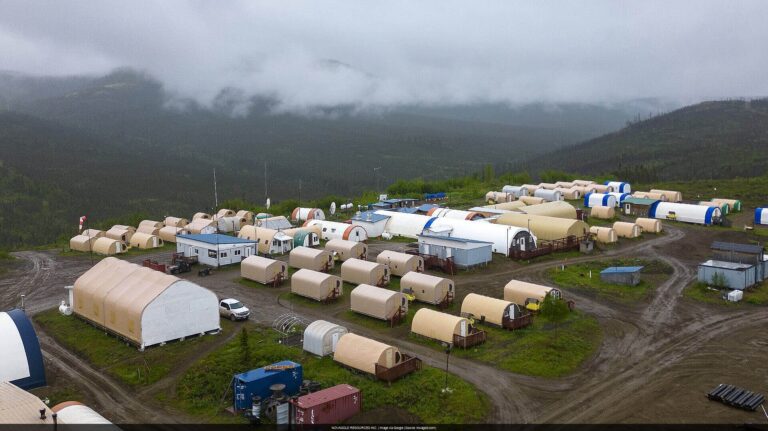

Remember that whole “will they, won’t they” dance with Barrick Gold over the Donlin Gold project? Well, consider this the “they did… something *completely different*” chapter. The 8-K filing itself lays it out: Barrick is OUT, and Paulson & Co. is IN, bringing a cool $800 million to the party. [[GREEN_FLAG]] Novagold chipped in another $200 million, giving them a controlling 60% stake in Donlin Gold, while Paulson snagged 40%. But, and this is a big but, they’ll have *equal* governance rights. Think of it as a power-sharing agreement in the Alaskan wilderness.

Barrick is OUT, Paulson is IN, and Donlin Gold just got an $1 Billion injection. This isn’t your grandpa’s gold mine anymore.

The press release (EX-99.1) doubles down on the “transformational” nature of the deal (their words, not mine, but I’m inclined to agree). [[GREEN_FLAG]] It also sheds light on Novagold’s financial health, confirming they have enough cash on hand for both the acquisition *and* the updated feasibility study for Donlin Gold. They’re even playing it cool with their existing debt to Barrick, opting not to prepay immediately but keeping that option open. Smart move, keeping their financial powder dry.

Now, for the legal nitty-gritty. The LLC Agreement (EX-10.1) [[GREEN_FLAG]] is the official rulebook for the new Donlin Gold LLC, outlining everything from board responsibilities to how they’ll handle future budgets and distributions. It’s like the prenuptial agreement for this new gold-rush marriage. And speaking of agreements, the amended promissory note (EX-10.2) [[GREEN_FLAG]] details how Novagold will be paying back Barrick – a cool $158.9 million. They’ve got a prepayment option, but with all the exciting developments at Donlin, they might need that cash elsewhere.

This isn’t just a cash infusion; it’s a complete restructuring of Donlin Gold. Novagold is clearly taking the reins, and Paulson is along for the ride (a very well-funded ride).

The Analyst’s Crystal Ball: NOVAGOLD RESOURCES INC. (NG) – What Now? (Updated June 04, 2025) 🔮

Sentiment Score from latest documents (this batch only): 86/100 (raw avg: 0.72)

Implication of Current Filings: Positive Momentum Building

Overall Outlook & Forecast

This is a major power play by Novagold. They’ve secured a controlling interest in one of the largest undeveloped gold deposits in the world, brought in a deep-pocketed partner, and restructured their debt. Things are looking shiny, but remember, this is still a long-term play.

What Would Make Us Yell “To The Moon!” (Go Long) 🚀

- Positive results from the updated feasibility study, confirming the project’s economic viability.

- Smooth progress on permitting and stakeholder engagement, paving the way for actual construction.

- A sustained increase in gold prices, further boosting the project’s potential value.

When We’d Hit The Eject Button (Go Short) 📉

- Unexpected cost overruns or technical challenges during the feasibility study update.

- Significant delays or roadblocks in the permitting process.

- A major deterioration in the relationship between Novagold and Paulson, disrupting project development.

The Mic Drop: So, What’s the Deal with NOVAGOLD RESOURCES INC.’s Latest Paper Trail?

This 8-K is more than just a routine filing; it’s a declaration of intent. Novagold is betting big on Donlin Gold, and they’ve brought in some serious muscle to help them. This is definitely a story worth watching, but as always, do your own research (DYOR) before making any investment decisions. Consider this your friendly neighborhood SEC-whisperer signing off.

Key Questions Answered by This 8-K From NOVAGOLD RESOURCES INC. (NG)

-

Who are the new owners of the Donlin Gold project?

Novagold now owns 60% of Donlin Gold, while Paulson & Co. owns the remaining 40%, following the acquisition of Barrick Gold’s stake.

-

How much did Novagold pay for their increased stake in Donlin Gold?

Novagold paid $200 million for an additional 10% interest, bringing their total stake to 60%.

-

What are the governance rights for Novagold and Paulson in the new Donlin Gold LLC?

Despite the unequal ownership split, Novagold and Paulson will have equal governance rights in the Donlin Gold project.

-

What happened to Novagold’s promissory note with Barrick Gold?

The note was amended and restated, allowing for a prepayment of $100 million within 18 months and modifying the security package.

-

What are Novagold’s plans for Donlin Gold following the acquisition?

Novagold plans to update the Feasibility Study, execute the 2025 drill program, and advance technical work, permitting, and stakeholder engagement.

-

How much does Novagold owe Barrick Gold after the acquisition?

Novagold owes Barrick Gold $158.9 million, as detailed in the Second Amended and Restated Secured Promissory Note.

P.S. The SEC saga never ends! As NOVAGOLD RESOURCES INC. files more, this analysis will evolve. Current as of June 04, 2025.