Aptevo Therapeutics: Promising Drug, Precarious Finances – A Story of Two Narratives

Aptevo Therapeutics Inc. (APVO) filed a significant 8-K on May 23, 2025, and it’s a real head-scratcher. Let’s unpack the key documents and see what story they tell.

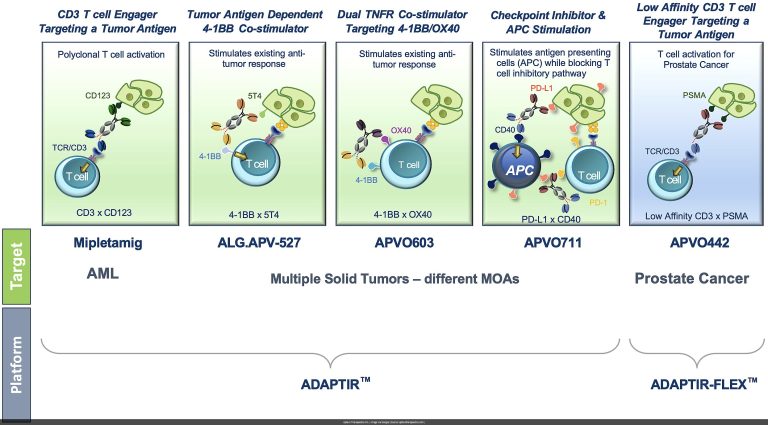

The initial 8-K itself simply announced the Q1 2025 financial results, but the attached EX-99.1 press release offered some genuinely good news. Mipletamig, their lead drug candidate for acute myeloid leukemia (AML), showed a 90% remission rate in frontline patients across two trials. Even better, the ongoing RAINIER trial has reported no cytokine release syndrome (CRS), confirming the drug’s favorable safety profile. 9 of 10 (90%) frontline patients across two trials have achieved remission with mipletamig in combination with standard of care therapy

, the press release proudly proclaimed. 🎉

However, the accompanying 10-Q paints a much bleaker picture. Aptevo is facing “substantial doubt” about its ability to continue as a going concern for the next year. Recurring losses, negative cash flows, and the urgent need to raise additional funds are to blame. The company acknowledges these issues and has taken steps to address them, including stock offerings that raised $3.7 million and a sales agreement with Roth Capital Partners for up to $50 million in potential future offerings. They’ve also enacted a reverse stock split (between 1-for-6 and 1-for-20) to regain compliance with Nasdaq listing requirements. 😟

A subsequent 8-K on May 23rd confirmed the Nasdaq non-compliance notice and announced a 1-for-20 reverse stock split, effective immediately. This split, while aimed at regaining compliance, underlines the seriousness of Aptevo’s financial situation. Several related exhibits (EX-31.1, EX-31.2, EX-32.1, EX-32.2) contain certifications from the CEO and CFO regarding the accuracy of the 10-Q filing, but these are standard procedure and don’t change the fundamental financial challenges. Further filings confirmed the details of the reverse stock split and the at-the-market offering. 😬

Aptevo’s mipletamig continues to show impressive clinical results, but the company’s financial health remains a major concern.

The reverse stock split and ongoing fundraising efforts are crucial for Aptevo’s survival, but there’s no guarantee of success.

While the positive drug trial data provides a glimmer of hope, the “going concern” warning casts a long shadow over Aptevo’s future.

The Analyst’s Crystal Ball: Aptevo Therapeutics Inc. (APVO) – What Now? (Updated May 26, 2025) 🔮

Sentiment Score from latest documents (this batch only): 38/100 (raw avg: -0.23)

Implication of Current Filings: Headwinds Increasing

Overall Outlook & Forecast

These filings reveal a stark contrast: promising clinical developments versus dire financial straits. While mipletamig offers a potential lifeline, the “going concern” warning is a serious red flag. The company’s survival hinges on its ability to secure further funding and regain Nasdaq compliance. This suggests a cautious outlook for at least the next year.

What Would Make Us Yell “To The Moon!” (Go Long) 🚀

- Successful completion of a substantial funding round that alleviates the going concern issue.

- Continued positive clinical data for mipletamig, leading to a potential partnership or buyout.

- Regaining and maintaining compliance with Nasdaq listing requirements.

When We’d Hit The Eject Button (Go Short) 📉

- Failure to secure sufficient funding, leading to potential bankruptcy.

- Negative or inconclusive results from ongoing or future clinical trials for mipletamig.

- Delisting from Nasdaq.

The Mic Drop: So, What’s the Deal with Aptevo Therapeutics Inc.’s Latest Paper Trail?

Aptevo’s latest filings are a classic good news/bad news scenario. The positive drug data is exciting, but the financial woes are a serious threat. This represents a significant shift towards increased risk for investors. As always, this isn’t financial advice, so do your own research (DYOR) before making any investment decisions.

Possible Google Searches After This 8-K From Aptevo Therapeutics Inc. (APVO)

- Aptevo Therapeutics going concern warning

- APVO reverse stock split details

- Mipletamig clinical trial results

- Aptevo Therapeutics Nasdaq delisting risk

- APVO stock forecast

- Aptevo Therapeutics financing efforts

- Impact of reverse stock split on APVO stock

- Is Aptevo Therapeutics a good investment?

- APVO Q1 2025 financial results

- What is mipletamig?

- How to buy APVO stock

- Aptevo Therapeutics recent SEC filings

- Risks of investing in Aptevo Therapeutics

- APVO stock price prediction

- Aptevo Therapeutics AML treatment

P.S. The SEC saga never ends! As Aptevo Therapeutics Inc. files more, this analysis will evolve. Current as of May 26, 2025.