ASPI Makes Power Moves: HALEU Deals and a Helium Heist!

ASP Isotopes Inc. (ASPI) filed a hefty 8-K on May 22, 2025, and it’s packed with more twists and turns than your favorite streaming drama. So grab your popcorn (or preferred investment snack) as we break down the key takeaways.

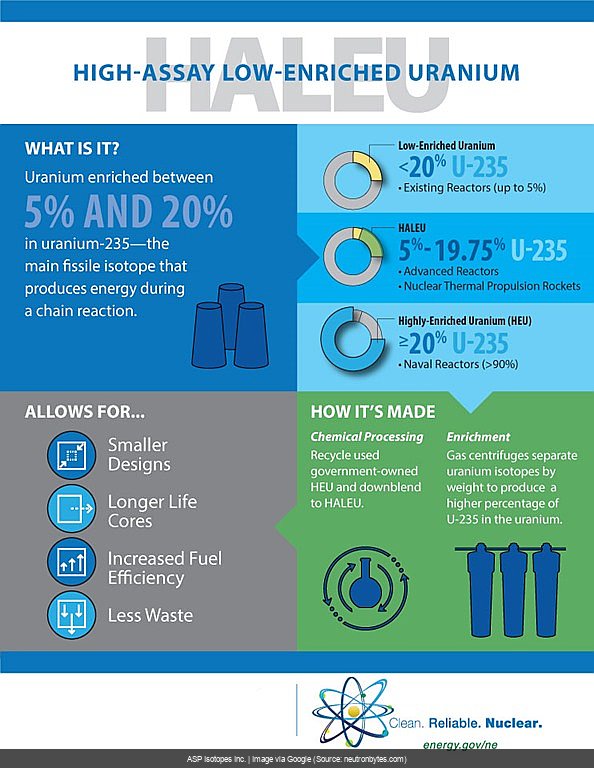

First off, the main 8-K form announces not one, but two major agreements with TerraPower. ASPI has secured a loan to build a new uranium enrichment facility capable of producing High-Assay Low-Enriched Uranium (HALEU), the fuel of the future for advanced nuclear reactors. Even better? They’ve also snagged supply agreements to provide TerraPower with this sweet, sweet HALEU. ASPI and/or certain of its subsidiaries have entered into a loan agreement with TerraPower […] related to financing support for the construction of a new uranium enrichment facility capable of producing High Assay Low-Enriched Uranium (HALEU) and supply agreements for the future supply of HALEU to TerraPower, as a customer.

The EX-99.1 Press Release elaborates, revealing the facility will be built in Pelindaba, South Africa, and outlines a 10-year deal to supply up to 150 metric tons of HALEU. This is a huge win for ASPI, solidifying their role in the burgeoning advanced nuclear energy market. ([[GREEN_FLAG]])

ASPI’s deal with TerraPower is a major leap forward, securing both funding and a guaranteed customer for their HALEU production.

But wait, there’s more! ASPI also announced its intention to acquire Renergen Limited, a South African company specializing in helium and natural gas production. The second 8-K and the related press release (EX-99.2) detail this surprise move, which diversifies ASPI’s portfolio and positions them as a key player in multiple critical materials markets. While this acquisition is potentially accretive to earnings, it also comes with risks. ASPI has already extended a $30 million bridge loan to Renergen, suggesting the latter might be facing financial headwinds. ([[GREEN_FLAG]], [[RED_FLAG]])

Unfortunately, not all is sunshine and rainbows. ASPI’s Q1 2025 10-Q filing, also included in the 8-K, revealed a widening net loss and, more concerningly, ineffective disclosure controls. This throws a bit of a wrench in the works and raises questions about ASPI’s internal financial reporting. ([[RED_FLAG]])

While the TerraPower deal is a game-changer, ASPI’s acquisition of a financially stressed Renergen and their own internal control issues introduce significant uncertainty.

The Analyst’s Crystal Ball: ASP Isotopes Inc. (ASPI) – What Now? (Updated May 26, 2025) 🔮

Sentiment Score from latest documents (this batch only): 58/100 (raw avg: 0.16)

Implication of Current Filings: Mixed Bag – Potential and Peril

Overall Outlook & Forecast

ASPI’s latest filings present a complex picture. The TerraPower agreements are a major win, potentially transforming the company into a leading HALEU supplier. However, the Renergen acquisition, while strategically sound, carries significant financial risks. Coupled with ASPI’s own internal control issues, this suggests a cautious outlook for the next 1-2 years. The company’s success hinges on navigating these challenges effectively.

What Would Make Us Yell “To The Moon!” (Go Long) 🚀

- Successful integration of Renergen and exceeding synergy targets.

- Resolution of internal control weaknesses and improved financial reporting transparency.

- Securing additional non-dilutive financing for the HALEU facility and expansion plans.

When We’d Hit The Eject Button (Go Short) 📉

- Failure to meet the conditions precedent for the TerraPower loan or supply agreements.

- Significant cost overruns or delays in the construction of the HALEU enrichment facility.

- Further deterioration of Renergen’s financial position or difficulties in integrating the acquisition.

The Mic Drop: So, What’s the Deal with ASP Isotopes Inc.’s Latest Paper Trail?

ASPI is playing a high-stakes game. The TerraPower deals are a potential home run, but the Renergen acquisition and internal control issues add considerable risk to the mix. This isn’t a slam dunk, folks. It’s more of a nail-biter. As always, this isn’t financial advice, so do your own due diligence before making any investment decisions.

Possible Google Searches After This 8-K From ASP Isotopes Inc. (ASPI)

- ASPI TerraPower HALEU supply agreement details

- ASPI Renergen acquisition terms

- ASPI Q1 2025 financial results

- ASPI disclosure controls weaknesses

- Renergen financial difficulties

- ASPI HALEU enrichment facility South Africa

- TerraPower Natrium reactor HALEU supply

- ASPI stock forecast

- ASPI diversification strategy

- Risks of investing in ASPI

- ASPI helium and natural gas production

- Impact of Renergen acquisition on ASPI

- ASPI future growth prospects

- ASPI stock buy or sell

- ASPI SEC filings analysis

P.S. The SEC saga never ends! As ASP Isotopes Inc. files more, this analysis will evolve. Current as of May 26, 2025.