AST SpaceMobile Reaches for the Stars with $500 Million ATM Offering

On May 13, 2025, AST SpaceMobile, Inc. (ASTS) filed an 8-K, and let me tell you, this isn’t your average paperwork snoozefest. We’re diving into the key docs to see what this means for the company’s mission to bring space-based broadband to your phone.

The 8-K form itself lays out the big news: AST SpaceMobile has entered into a new $500 million at-the-market (ATM) equity distribution agreement. This deal allows them to sell shares over the next three years. They also terminated a previous ATM agreement from September 5, 2024. The new agreement brings in a larger number of sales agents, widening their potential investor pool. This move suggests ASTS is gearing up for some major developments, and they’re going to need the funds to make it happen. AST SpaceMobile, Inc. (“AST”) entered into an Equity Distribution Agreement (the “ATM Sales Agreement”) to sell shares of the Company’s Class A common stock… having an aggregate offering price of up to $500.0 million

The EX-1.1 document gets into the nitty-gritty of the agreement, listing the underwriters (quite a crew!) and outlining the terms. The maximum compensation to the underwriters is 3.0% of the gross proceeds, a standard fee for this kind of arrangement. ✅

Finally, the EX-5.1 document is the legal opinion confirming everything is above board and legally sound. ✅ McGuireWoods LLP acted as special counsel, giving this offering a further stamp of approval.

AST SpaceMobile is now equipped with a $500 million ATM offering, providing significant financial flexibility for the next three years.

The involvement of a larger group of sales agents in the new ATM agreement suggests a broader reach for potential investors.

The legal opinion from McGuireWoods LLP reinforces the validity and legality of the offering, providing assurance to investors.

The Analyst’s Crystal Ball: AST SpaceMobile, Inc. (ASTS) – What Now? (Updated May 26, 2025) 🔮

Sentiment Score from latest documents (this batch only): 80/100 (raw avg: 0.60)

Implication of Current Filings: Positive Momentum Building

Overall Outlook & Forecast

This $500 million ATM offering is a significant development for AST SpaceMobile, giving them the resources to pursue their ambitious goals. It suggests confidence in their ability to execute and attract further investment. This points towards a positive outlook for the next 1-2 years.

What Would Make Us Yell “To The Moon!” (Go Long) 🚀

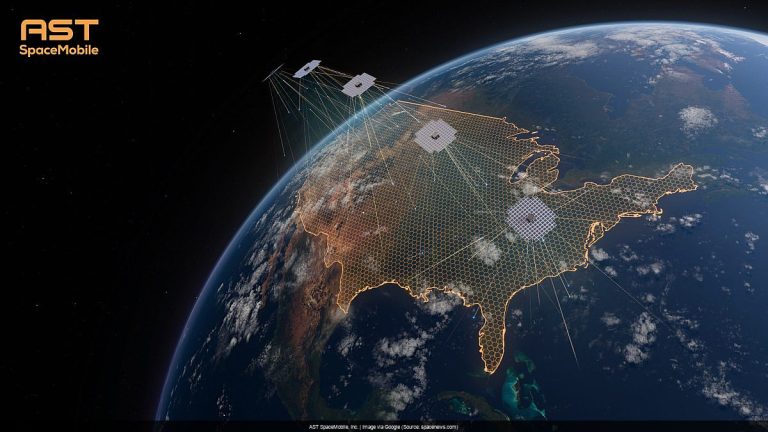

- Successful deployment and operation of additional satellites, expanding coverage and demonstrating the viability of their technology.

- Securing major partnerships with telecom providers, validating their business model and opening up access to a wider customer base.

- Strong revenue growth and positive cash flow, demonstrating the commercial success of their space-based broadband service.

When We’d Hit The Eject Button (Go Short) 📉

- Significant delays or setbacks in satellite deployment or technological development, raising doubts about their ability to deliver on their promises.

- Failure to secure key partnerships or regulatory approvals, hindering their ability to expand and commercialize their service.

- Continued cash burn and inability to achieve profitability, raising concerns about their long-term financial viability.

The Mic Drop: So, What’s the Deal with AST SpaceMobile, Inc.’s Latest Paper Trail?

This 8-K filing from AST SpaceMobile is more than just routine paperwork. It’s a clear signal of their ambition and intent to scale their space-based broadband network. While the road ahead is undoubtedly filled with challenges, this $500 million ATM offering gives them the fuel they need to reach for the stars. As always, this isn’t financial advice, so do your own research (DYOR) before making any investment decisions.

Possible Google Searches After This 8-K From AST SpaceMobile, Inc. (ASTS)

- AST SpaceMobile $500 million ATM offering

- ASTS stock forecast after ATM offering

- What does AST SpaceMobile’s new ATM agreement mean for investors?

- Who are the underwriters for AST SpaceMobile’s ATM offering?

- How will AST SpaceMobile use the $500 million raised?

- AST SpaceMobile future plans and expansion

- Impact of AST SpaceMobile’s ATM offering on stock price

- ASTS stock analysis after May 2025 8-K

- AST SpaceMobile satellite deployment updates

- AST SpaceMobile partnerships with telecom companies

- Risks and opportunities for investing in AST SpaceMobile

- AST SpaceMobile financial outlook and projections

- Is AST SpaceMobile stock a buy after the ATM offering?

- AST SpaceMobile SEC filings analysis

P.S. The SEC saga never ends! As AST SpaceMobile, Inc. files more, this analysis will evolve. Current as of May 26, 2025.