Copart’s Q3 2025 10-Q: More Green Flags Than a Golf Course ⛳

Welcome back to the ongoing saga of Copart, Inc. (CPRT), where we’re chronicling every twist and turn of their SEC filings like it’s the latest binge-worthy drama. This installment covers the 10-Q dropped on June 3, 2025, and let me tell you, it’s a good one. Consider this your definitive guide, the one Google will be begging you to click.

As a quick recap (because we’re all about context here), previous filings (the 8-K and EX-99.1 from May 22nd) hinted at a strong Q3. This 10-Q? It’s not hinting anymore. It’s shouting it from the rooftops.

Copart’s Q3 2025 performance wasn’t just good, it was a masterclass in how to run an online vehicle auction business. The numbers don’t lie, and these numbers are doing the electric slide right into profit town.

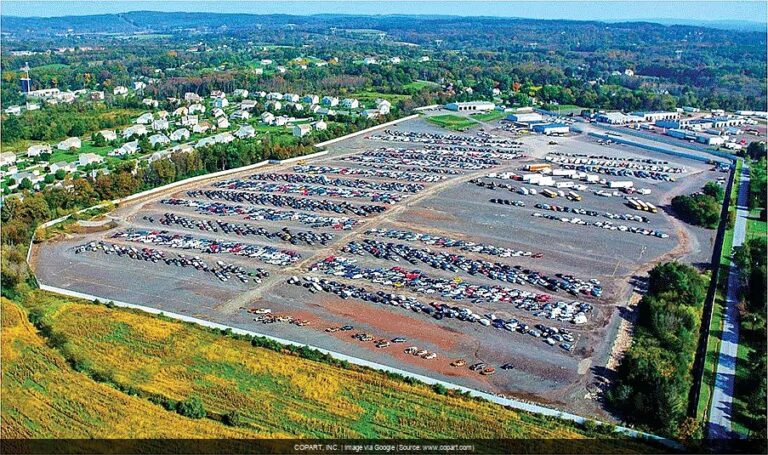

The 10-Q itself breaks down the juicy details. Service revenues? Up 9.3% year-over-year. Net income? A cool $406.6 million, a healthy jump from last year’s $382.3 million. [[GREEN_FLAG]] They’re expanding internationally too, planting their flag in new locations across the globe, from the U.S. and Canada to the U.K. and Spain. World domination, one junkyard at a time.

But wait, there’s more! We’ve got not one, not two, but *four* certifications from the CEO and CFO (EX-31.1, EX-31.2, EX-32.1, EX-32.2). It’s like they’re saying, “We’re so confident in these numbers, we’ll sign them four times!” [[GREEN_FLAG]] Transparency? We love to see it.

Four certifications? It’s like they’re double-dog daring anyone to question their numbers. Confidence level: over 9000.

The Analyst’s Crystal Ball: COPART, INC. (CPRT) – What Now? (Updated June 04, 2025) 🔮

Sentiment Score from latest documents (this batch only): 97/100 (raw avg: 0.94)

Implication of Current Filings: Positive Momentum Building

Overall Outlook & Forecast

This 10-Q paints a rosy picture for Copart. Their core business is booming, they’re expanding their global footprint, and their financials are looking healthier than ever. The momentum is definitely on their side.

What Would Make Us Yell “To The Moon!” (Go Long) 🚀

- Continued growth in service revenues and net income in the next quarter.

- Successful integration and strong performance from their new international facilities.

- Announcements of further strategic partnerships or acquisitions.

When We’d Hit The Eject Button (Go Short) 📉

- A significant slowdown in the used car market, impacting demand for their auction services.

- Unexpected regulatory hurdles in their international expansion plans.

- A decline in profit margins due to increased operating costs.

The Mic Drop: So, What’s the Deal with COPART, INC.’s Latest Paper Trail?

Copart’s latest 10-Q is a clear signal that they’re firing on all cylinders. This isn’t just a good quarter; it’s a continuation of a strong growth trajectory. But remember, folks, this is just one piece of the puzzle. Always Do Your Own Research (DYOR) before making any investment decisions. Consider this your starting point, not your finish line.

Key Questions Answered by This 10-Q From COPART, INC. (CPRT)

-

Did Copart’s Q3 2025 10-Q confirm the positive trends indicated in earlier releases?

Yes, the 10-Q confirmed the strong financial performance previously reported, showing robust growth in service revenue and net income.

-

How did Copart’s service revenues perform in Q3 2025?

Service revenues increased by 9.3% compared to Q3 2024, driven by growth in both U.S. and international markets.

-

What was Copart’s net income for Q3 2025?

Net income attributable to Copart, Inc. reached $406.6 million in Q3 2025, up from $382.3 million in Q3 2024.

-

Is Copart continuing its international expansion efforts?

Yes, the 10-Q highlights Copart’s ongoing expansion, with new facilities opened in various locations globally, including the U.S., U.K., Canada, and Spain.

-

Did the CEO and CFO certify the accuracy of the 10-Q filing?

Yes, both the CEO and CFO provided multiple certifications confirming the accuracy and completeness of the financial information presented in the 10-Q.

-

What is Copart’s current cash position?

As of April 30, 2025, Copart had $2.37 billion in cash and cash equivalents, significantly higher than the $1.51 billion reported on July 31, 2024.

P.S. The SEC saga never ends! As COPART, INC. files more, this analysis will evolve. Current as of June 04, 2025.