8×8’s 10-K: Balancing Act Between Innovation and Financial Tightrope

8×8, Inc. filed its 10-K on May 22, 2025, and it’s a mixed bag of news. Let’s unpack the official pronouncements and see what they tell us about the company’s future.

The 8-K form itself simply announced the release of the financial results for the quarter and fiscal year ended March 31, 2025. The real meat is in the exhibits.

The EX-99.1 Press Release provided more detail. Both Q4 2025 and fiscal year 2025 revenue saw declines (🚩). However, the company emphasized that excluding former Fuze customers, service revenue growth actually accelerated. They also highlighted new AI-powered product innovations and industry recognitions (✅). The guidance for fiscal year 2026 projects relatively flat revenue.

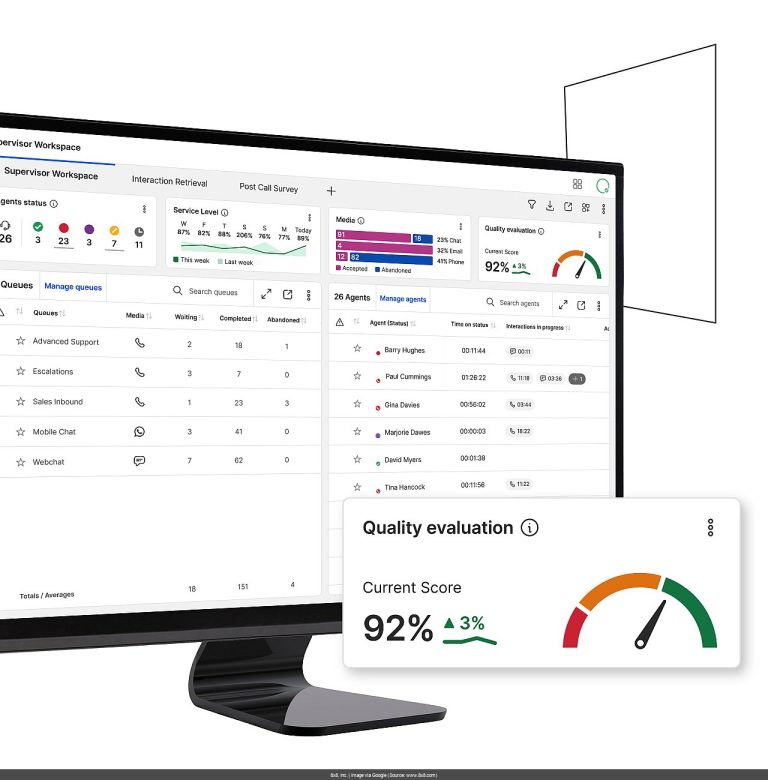

The 10-K filing itself paints a more concerning picture. 8×8 acknowledges a history of losses and anticipates more to come (🚩). While they repaid a term loan and entered into a new one, they’re also under FCC investigation (🚩). The 10-K does confirm the company’s focus on AI and serving mid-market and enterprise customers.

A few other exhibits offer additional insights. The EX-4.1 document outlines some anti-takeover provisions (🚩), while EX-19.1 details a comprehensive insider trading policy (✅). The CEO and CFO certifications in EX-31.1, EX-31.2, EX-32.1, and EX-32.2 affirm the accuracy of the 10-K and the effectiveness of internal controls (✅).

While the overall revenue trend is down, the growth excluding Fuze customers offers a glimmer of hope.

Our results…reflect multiple transitions as we build a foundation for durable growth and profitability.

The FCC investigation and continued losses raise some serious concerns for investors.

The Analyst’s Crystal Ball: 8×8, Inc. (EGHT) – What Now? (Updated May 22, 2025) 🔮

Sentiment Score from latest documents (this batch only): 54/100 (raw avg: 0.08)

Implication of Current Filings: Holding Pattern Continues

Overall Outlook & Forecast

This 10-K paints a picture of a company in transition. While 8×8 is investing in innovation and focusing on its core customer base, the ongoing losses, regulatory scrutiny, and flat revenue projections create uncertainty. This suggests a neutral stance for the medium term, with the potential for positive movement depending on the success of their strategic initiatives and the resolution of the FCC investigation.

What Would Make Us Yell “To The Moon!” (Go Long) 🚀

- Significant and sustained revenue growth demonstrating the success of their new strategic focus.

- Positive resolution of the FCC investigation and a clear path to profitability.

- Successful integration of AI-powered features that drive customer acquisition and retention.

When We’d Hit The Eject Button (Go Short) 📉

- Further decline in revenue or a failure to achieve profitability within a reasonable timeframe.

- Negative outcome of the FCC investigation resulting in substantial fines or penalties.

- Loss of key customers or market share to competitors.

The Mic Drop: So, What’s the Deal with 8×8, Inc.’s Latest Paper Trail?

8×8 is walking a tightrope. They’re talking the talk with AI and enterprise focus, but they need to walk the walk financially. This 10-K doesn’t signal a dramatic shift in either direction, but it certainly gives investors plenty to chew on. As always, this isn’t financial advice; do your own research!

Possible Google Searches After This 10-K From 8×8, Inc. (EGHT)

- 8×8 Q4 2025 earnings results

- 8×8 FCC investigation details

- 8×8 future profitability outlook

- 8×8 AI product innovations

- 8×8 stock forecast 2026

- 8×8 Fuze integration impact

- 8×8 debt management strategy

- 8×8 target customer segments

- 8×8 insider trading policy

- 8×8 anti-takeover provisions

- 8×8 international subsidiaries

- 8×8 management team

- 8×8 competitor analysis

- 8×8 cloud communications market share

P.S. The SEC saga never ends! As 8×8, Inc. files more, this analysis will evolve. Current as of May 22, 2025.