Informatica Gets Snapped Up by Salesforce: An 8-K Breakdown (Because SEC Filings Shouldn’t Be This Boring)

Welcome back to the ongoing saga of Informatica Inc.! Consider this your definitive guide to the latest plot twist – a juicy 8-K filing dropped on May 27, 2025, that’s about as subtle as a foghorn in a library. Let’s unpack why this isn’t just another boring SEC document.

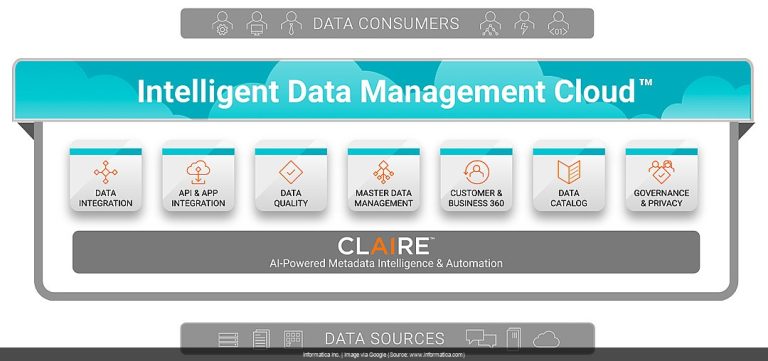

The main 8-K form itself lays out the groundwork: Informatica Inc. has agreed to be acquired by Salesforce, Inc. [[GREEN_FLAG]] Yep, you read that right. Salesforce is adding another piece to its ever-expanding empire. The filing details the merger agreement, essentially outlining how Informatica will become a wholly-owned subsidiary.

Salesforce and Informatica? It’s like peanut butter and jelly… if peanut butter was data management and jelly was, well, everything else Salesforce does.

But the real meat and potatoes (or perhaps the algorithm and data streams?) are in the accompanying EX-99.1 press release. [[GREEN_FLAG]] Here we get the price tag: a cool ~$8 billion, or $25 per share. This confirms the rumors swirling around like vultures over… well, you get the picture. The release also gives us the “why” – apparently, Informatica’s data management prowess is going to supercharge Salesforce’s AI capabilities. [[GREEN_FLAG]] Salesforce even projects this acquisition will boost their non-GAAP operating margin, EPS, and free cash flow starting in year two. Accretive, they call it. Sounds fancy.

Eight billion dollars. That’s enough to buy a LOT of data. Or, you know, a small island nation.

“This proposed acquisition will be a key enabler for Salesforce’s next phase of AI-driven growth.” – Robin Washington. Translation: Data is the new oil, and Salesforce just bought a gusher.

The Analyst’s Crystal Ball: Informatica Inc. (INFA) – What Now? (Updated May 27, 2025) 🔮

Sentiment Score from latest documents (this batch only): 98/100 (raw avg: 0.95)

Implication of Current Filings: Positive Momentum Building

Overall Outlook & Forecast

This acquisition seems like a win-win (unless you’re a competitor, in which case, condolences). Informatica gets absorbed into a tech behemoth, and Salesforce gets a powerful data engine to fuel its AI ambitions. The real question is integration. Can Salesforce smoothly incorporate Informatica without causing too much internal disruption? History tells us… sometimes.

What Would Make Us Yell “To The Moon!” (Go Long) 🚀

- Smooth integration with minimal disruption to existing Salesforce services.

- Evidence of Informatica’s data management boosting Salesforce’s AI capabilities in real-world applications.

- Salesforce exceeding its projected financial gains from the acquisition.

When We’d Hit The Eject Button (Go Short) 📉

- Integration issues that negatively impact Salesforce’s existing services.

- Failure to leverage Informatica’s data management capabilities effectively for AI advancements.

- Salesforce missing its projected financial targets related to the acquisition.

The Mic Drop: So, What’s the Deal with Informatica Inc.’s Latest Paper Trail?

In short, Informatica is about to become a Salesforce subsidiary in a multi-billion dollar deal. This 8-K filing, while dry on the surface, signals a potentially major shift in the data and AI landscape. As always, do your own research (DYOR) before making any investment decisions, because the SEC doesn’t offer financial advice (and neither do I!).

Possible Google Searches After This 8-K From Informatica Inc. (INFA)

- Why is Salesforce acquiring Informatica?

- How much is Salesforce paying for Informatica?

- What does the Informatica acquisition mean for Salesforce customers?

- What are the strategic benefits of the Salesforce-Informatica merger?

- Will the Informatica acquisition be accretive for Salesforce?

- What is the expected impact of the Informatica acquisition on Salesforce’s financials?

- When will the Salesforce-Informatica deal close?

- What are the risks associated with the Salesforce-Informatica acquisition?

- How will Informatica be integrated into Salesforce?

- What does the Informatica acquisition mean for the data management industry?

- What does the Informatica acquisition mean for the AI industry?

- Informatica stock price after Salesforce acquisition announcement

- Salesforce Informatica merger details

- Informatica 8-K filing May 27, 2025

P.S. The SEC saga never ends! As Informatica Inc. files more, this analysis will evolve. Current as of May 27, 2025.