Altria Shakes Things Up: New Controller, Shareholder Votes, and the Future of Smokes (and Not-Smokes)

Altria Group, Inc. (MO) recently filed an 8-K on May 19, 2025, and it’s packed with more than just the usual legalese. Let’s unpack what this latest dispatch from Big Tobacco HQ means for investors.

The 8-K form itself covers a few key areas. First up, a changing of the guard: VP and Controller Steven D’Ambrosia is retiring, with Katie F. Patterson stepping into the role. [[GREEN_FLAG]] While retirements happen, smooth transitions are key in finance, so hopefully Ms. Patterson is ready to hit the ground running. The filing also details shareholder approvals from Altria’s annual meeting. Shareholders gave the thumbs-up to the 2025 Performance Incentive Plan and the 2025 Stock Compensation Plan for Non-Employee Directors. They also ratified the choice of PricewaterhouseCoopers as the independent auditor – because someone’s gotta make sure the numbers add up. Finally, and perhaps most importantly for execs, shareholders approved (on an advisory basis) the compensation of Altria’s named executive officers. [[NEUTRAL_FACE]] No surprises there, but it’s always worth noting.

Altria shareholders approved the 2025 Performance Incentive Plan, the compensation of executive officers, and ratified the selection of their auditor.

On May 13, 2025, Steven D’Ambrosia, Vice President and Controller of Altria Group, Inc. (“Altria”), announced his intention to retire as Vice President and Controller effective July 31, 2025.

The Analyst’s Crystal Ball: ALTRIA GROUP, INC. (MO) – What Now? (Updated May 22, 2025) 🔮

Sentiment Score from latest documents (this batch only): 60/100 (raw avg: 0.20)

Implication of Current Filings: Holding Pattern Continues

Overall Outlook & Forecast

This 8-K doesn’t drastically alter Altria’s trajectory. It confirms the company is moving forward with planned compensation structures and has a succession plan in place for a key financial role. The neutral sentiment reflects the routine nature of these announcements. Without a provided historical summary, it’s difficult to assess the long-term impact, but these filings suggest business as usual for now. This points towards a neutral outlook for the short term (next 6-12 months).

What Would Make Us Yell “To The Moon!” (Go Long) 🚀

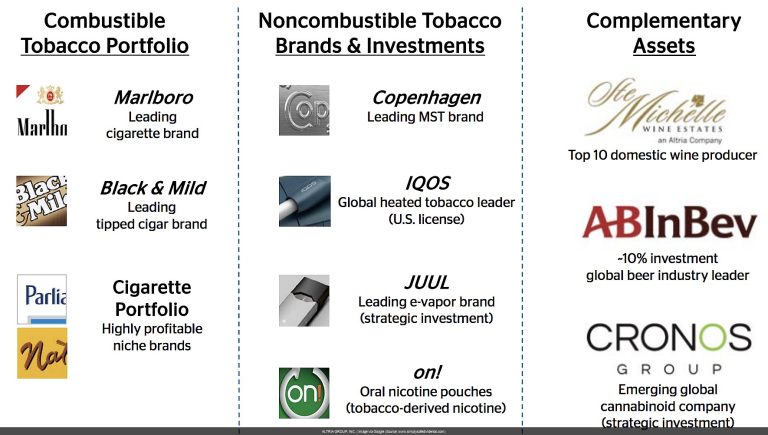

- Significant diversification away from traditional tobacco products showing strong growth.

- Innovative new products gaining substantial market share in the non-combustible nicotine space.

- Regulatory changes that benefit Altria’s existing business or open new opportunities.

When We’d Hit The Eject Button (Go Short) 📉

- Accelerated decline in traditional cigarette sales beyond current projections.

- Failure of new product lines to gain traction in the market.

- Increased regulatory pressure or litigation that significantly impacts Altria’s profitability.

The Mic Drop: So, What’s the Deal with ALTRIA GROUP, INC.’s Latest Paper Trail?

Altria’s latest 8-K is less a bombshell and more a routine checkup. It gives investors a glimpse into the inner workings and confirms some expected moves. No major red flags waving here, but no earth-shattering news either. As always, this isn’t financial advice, so do your own research before making any investment decisions.

Possible Google Searches After This 8-K From ALTRIA GROUP, INC. (MO)

- Altria Group Steven D’Ambrosia retirement

- Katie F. Patterson Altria Controller

- Altria 2025 Performance Incentive Plan

- Altria executive compensation 2025

- MO stock news

- Altria Group shareholder meeting results

- Altria PricewaterhouseCoopers auditor

- Future of Altria stock

- Altria diversification strategy

- Altria non-combustible nicotine products

- Impact of regulation on Altria

- Altria cigarette sales forecast

P.S. The SEC saga never ends! As ALTRIA GROUP, INC. files more, this analysis will evolve. Current as of May 22, 2025.