Okta Q1 FY26: Solid Start, But Can They Keep the Party Going? 🎉

Welcome back to the ongoing saga of Okta, Inc., where we decode the cryptic messages hidden within their SEC filings. Consider this your definitive guide to the latest chapter, the 8-K filed on May 27, 2025. Buckle up, because things are about to get interesting (or as interesting as financial reports can get).

The main 8-K filing itself is pretty standard fare, announcing the release of Okta’s Q1 FY26 financial results. It also helpfully reminds us where Okta likes to hang out online (their investor relations website and blog), just in case you were worried about missing any juicy tidbits.

But the real meat and potatoes (or tofu and quinoa, if you’re so inclined) is in the EX-99.1 press release. This is where Okta drops the bombshell: a “solid start” to FY26. And by solid, they mean 12% YoY revenue growth, record operating profit, and free cash flow that would make a Scrooge McDuck blush. [[GREEN_FLAG]] Looks like those identity solutions are still in high demand, even with the rise of the robot overlords (just kidding… mostly).

Okta had a solid start to FY26 highlighted by record operating profit and another quarter of robust free cash flow.

But wait, there’s more! RPO (Remaining Performance Obligations) is up 21% YoY, and cRPO (current RPO) is up a respectable 14%. [[GREEN_FLAG]] This basically means Okta has a healthy backlog of business and a strong pipeline for future revenue. Think of it as a packed dance card for the foreseeable future.

However, Okta is also throwing out a little caution to the wind. They’re being prudent with their forward guidance, citing “go-to-market specialization” and potential economic headwinds. Translation: They’re killing it now, but the future is always a bit hazy. Smart move, Okta. Don’t want to get too ahead of yourselves.

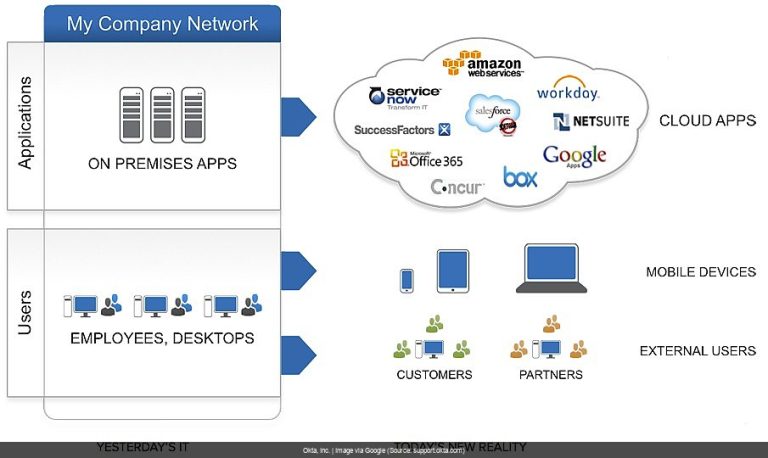

The world’s biggest organizations continue to turn to Okta to solve identity security across their workforces, customers, and AI use cases.

The Analyst’s Crystal Ball: Okta, Inc. (OKTA) – What Now? (Updated May 27, 2025) 🔮

Sentiment Score from latest documents (this batch only): 68/100 (raw avg: 0.35)

Implication of Current Filings: Positive Momentum Building

Overall Outlook & Forecast

Okta’s Q1 results are a definite win, showing continued growth and profitability. The strong RPO and cRPO numbers suggest this positive trend is likely to continue in the near term. However, their cautious guidance suggests some potential bumps in the road. Overall, the outlook is cautiously optimistic – kind of like expecting sunshine but packing an umbrella just in case.

What Would Make Us Yell “To The Moon!” (Go Long) 🚀

- Continued strong performance in key metrics like revenue, operating profit, and free cash flow in the next quarter.

- Positive revisions to their forward guidance, indicating increased confidence in future growth.

- Announcements of major new partnerships or client wins, solidifying their position in the market.

When We’d Hit The Eject Button (Go Short) 📉

- A significant miss on their next earnings report, suggesting the current positive momentum is unsustainable.

- Negative revisions to their forward guidance, indicating worsening economic conditions or increased competition.

- Any indication of security breaches or other operational issues that could damage their reputation.

The Mic Drop: So, What’s the Deal with Okta, Inc.’s Latest Paper Trail?

Okta’s latest 8-K filing shows they’re not just surviving, they’re thriving. Solid financial results and a strong backlog suggest a bright future, but their cautious guidance keeps things grounded. Ultimately, this filing adds another interesting chapter to the Okta story, one worth paying attention to. As always, do your own research (DYOR) before making any investment decisions. We’re just here to make the SEC filings a little less painful.

Key Questions Answered by This 8-K From Okta, Inc. (OKTA)

-

How did Okta, Inc. perform in Q1 FY26?

Okta reported solid Q1 FY26 results, with 12% YoY revenue growth, record operating profit, and robust free cash flow, as detailed in their EX-99.1 press release.

-

What is Okta, Inc.’s outlook for the rest of FY26?

Okta is taking a prudent approach to forward guidance due to potential economic headwinds, but the current strong performance suggests positive momentum.

-

What were the key financial metrics reported by Okta, Inc.?

Key metrics include $688M revenue (+12% YoY), $4.084B RPO (+21% YoY), and $238M free cash flow (+35% YoY), according to the EX-99.1 press release.

-

Where does Okta, Inc. disclose material non-public information?

The 8-K filing indicates Okta uses its investor relations website (investor.okta.com) and blog (okta.com/blog) for material non-public information disclosure.

-

What is the sentiment surrounding Okta, Inc.’s latest filing?

The overall sentiment is positive, driven by strong Q1 results, but tempered by cautious forward guidance due to potential economic headwinds.

-

What are some potential future indicators of success for Okta, Inc.?

Continued strong financial performance, positive revisions to forward guidance, and major new partnerships would be positive signs for Okta.

P.S. The SEC saga never ends! As Okta, Inc. files more, this analysis will evolve. Current as of May 27, 2025.