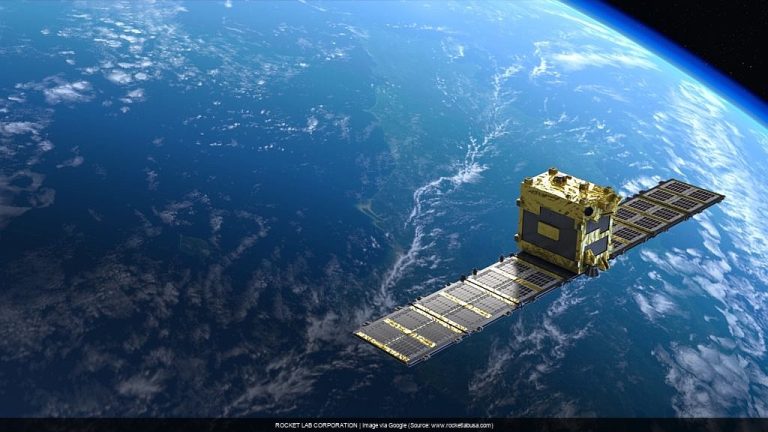

Rocket Lab to Acquire GEOST: From Launching Rockets to Building Spy Satellites? 🤔

Welcome back to the ongoing saga of Rocket Lab (RKLB), the space company that’s always got something cooking. This installment, hot off the presses from their May 27, 2025 8-K filing, is a real page-turner. Forget routine updates, this time we’re talking acquisitions, national security, and potentially a whole new chapter for the company.

The main 8-K filing itself is pretty straightforward: Rocket Lab is buying GEOST LLC. For a cool $275 million, with the potential for another $50 million in earnouts, RKLB is getting into the satellite payload game. [[GREEN_FLAG]] The deal, structured as a mix of cash and RKLB common stock, is expected to close sometime in the second half of 2025.

Rocket Lab isn’t just launching stuff into space anymore; they’re building the stuff *that goes* into space. This changes everything.

But the real meat of the story is in the accompanying EX-99.1 press release. This is where we learn that GEOST isn’t just some random company; they specialize in advanced electro-optical/infrared (EO/IR) payloads – the eyes and ears of satellites, especially those used for, ahem, national security. [[GREEN_FLAG]] This is a big deal. It means Rocket Lab isn’t just launching satellites anymore; they’re building the sophisticated tech that *goes* on those satellites.

So, what does this mean for Rocket Lab? The press release paints a picture of a company transforming itself into a one-stop shop for national security space solutions. [[GREEN_FLAG]] They’re talking about reduced integration risk, faster timelines, and lower costs. They’re also getting GEOST’s manufacturing facilities, IP, product inventory, and – perhaps most importantly – 115 skilled employees. Basically, they’re getting the whole enchilada.

This acquisition positions Rocket Lab as a disruptor in the national security space. They’re not just playing in the sandbox anymore; they’re building the whole damn playground.

The Analyst’s Crystal Ball: ROCKET LAB CORPORATION (RKLB) – What Now? (Updated May 27, 2025) 🔮

Sentiment Score from latest documents (this batch only): 92/100 (raw avg: 0.85)

Implication of Current Filings: Positive Momentum Building

Overall Outlook & Forecast

This acquisition could be a game-changer for Rocket Lab. Moving into the payload market gives them more control over the entire space mission process, from launch to operation. This vertical integration could be a key differentiator in a competitive market. However, integrating a new company is never easy. Execution will be key to realizing the full potential of this deal.

What Would Make Us Yell “To The Moon!” (Go Long) 🚀

- Successful integration of GEOST and evidence of synergy between the two companies.

- New contracts with government agencies or commercial customers for integrated space solutions.

- Positive revisions to Rocket Lab’s financial outlook based on the acquisition.

When We’d Hit The Eject Button (Go Short) 📉

- Difficulties integrating GEOST, leading to cost overruns or delays.

- Loss of key personnel from GEOST.

- Failure to secure new contracts leveraging the combined capabilities of Rocket Lab and GEOST.

The Mic Drop: So, What’s the Deal with ROCKET LAB CORPORATION’s Latest Paper Trail?

Rocket Lab just dropped a bombshell. This isn’t just about acquiring a company; it’s about a strategic shift that could redefine their place in the space industry. From launch provider to full-service space solutions provider? That’s a big leap. But as always, do your own research (DYOR) before making any investment decisions. This is just one analyst’s take on the latest chapter in the Rocket Lab story. Stay tuned, because this rocket is just getting started.

Key Questions Answered by This 8-K From ROCKET LAB CORPORATION (RKLB)

-

What company did Rocket Lab agree to acquire in its recent 8-K filing?

Rocket Lab announced the acquisition of GEOST LLC, a company specializing in advanced EO/IR payloads for satellites.

-

How much is Rocket Lab paying for GEOST LLC?

The purchase price is $275 million, with potential earnouts of up to $50 million.

-

When is the acquisition expected to close?

The transaction is anticipated to close in the second half of 2025.

-

What is the strategic rationale behind the acquisition?

The acquisition marks Rocket Lab’s entry into the satellite payload segment, strengthening its position as a provider of end-to-end national security space solutions.

-

How will the acquisition impact Rocket Lab’s capabilities?

It will allow Rocket Lab to offer complete, mission-critical space solutions, including advanced EO/IR payloads, reducing integration risk and accelerating timelines.

-

What key assets does GEOST bring to Rocket Lab?

GEOST brings manufacturing facilities, intellectual property, product inventory, and 115 skilled employees.

P.S. The SEC saga never ends! As ROCKET LAB CORPORATION files more, this analysis will evolve. Current as of May 27, 2025.