Target Takes Aim at Turnaround: Exec Shakeup and Disappointing Q1 Earnings

Target Corporation’s latest 8-K filing, dropped on May 21, 2025, brings some noteworthy developments. Let’s unpack the official documents and see what’s happening at everyone’s favorite bullseye-branded retailer.

The 8-K form itself revealed a significant leadership shakeup. Two key executives, Christina Hennington (Chief Strategy and Growth Officer) and Amy Tu (Chief Legal & Compliance Officer), are departing. The filing explicitly states these are “involuntary terminations without cause.” 🚩 While corporate speak often obscures the real reasons, this definitely raises eyebrows. Are these departures a sign of internal struggles, a change in strategic direction, or something else entirely?

A second 8-K filing from the same day pointed to the release of Target’s Q1 2025 earnings. The EX-99.1 Press Release filled in the details, and unfortunately, the news isn’t great. Q1 2025 sales were lower than expected, with comparable sales down 3.8% and net sales down 2.8% year-over-year. 🚩 Target acknowledged the shortfall, stating, We’re not satisfied with current performance and know we have opportunities to deliver faster progress on our roadmap for growth.

This confirms the negative sentiment surrounding the executive departures and suggests deeper challenges within the company. The lowered fiscal 2025 guidance (now expecting a low-single-digit decline in sales and adjusted EPS of $7.00 to $9.00) further reinforces this concern. 🚩

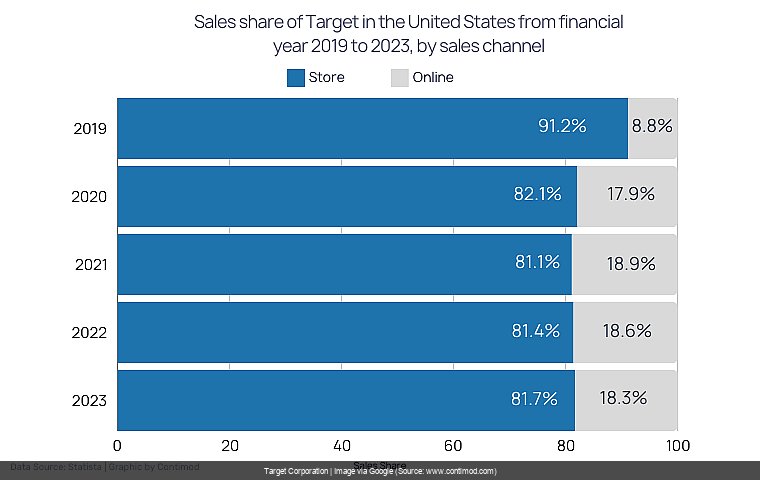

Not all is doom and gloom, however. Digital comparable sales saw a 4.7% increase, driven by a 36% jump in same-day delivery. This suggests Target’s online strategy might be finding some traction. 💚 The company’s establishment of an “acceleration office” to speed up decision-making and execution also hints at a proactive approach to tackling these performance issues. 💚

Two executive departures classified as “involuntary terminations without cause” raise significant questions about Target’s internal stability and strategic direction.

Despite some bright spots in digital growth, Target’s Q1 2025 earnings reveal a concerning decline in overall sales and a lowered fiscal year outlook.

The creation of an “acceleration office” suggests Target is taking steps to address its performance challenges, but the effectiveness of these efforts remains to be seen.

The Analyst’s Crystal Ball: Target Corporation (TGT) – What Now? (Updated May 22, 2025) 🔮

Sentiment Score from latest documents (this batch only): 30/100 (raw avg: -0.40)

Implication of Current Filings: Headwinds Increasing

Overall Outlook & Forecast

This latest batch of filings paints a concerning picture for Target. The combination of executive departures, weaker-than-expected earnings, and lowered guidance raises serious doubts about the company’s near-term prospects. While the digital growth and the “acceleration office” offer glimmers of hope, they are not enough to offset the overall negative trend. This suggests caution for at least the next year.

What Would Make Us Yell “To The Moon!” (Go Long) 🚀

- A significant rebound in sales growth, exceeding revised guidance, demonstrating the effectiveness of the “acceleration office” initiatives.

- Clear communication from Target outlining a revised strategic plan that addresses the underlying causes of the recent struggles and inspires confidence in the new leadership.

- Positive developments in the broader retail environment that alleviate the current headwinds impacting Target’s performance.

When We’d Hit The Eject Button (Go Short) 📉

- Further declines in sales and earnings beyond the revised guidance, indicating a deeper and more persistent problem.

- Additional executive departures or signs of internal turmoil, suggesting a lack of stability and direction.

- Failure to demonstrate tangible progress from the “acceleration office” initiatives within the next few quarters.

The Mic Drop: So, What’s the Deal with Target Corporation’s Latest Paper Trail?

Target’s latest filings are a definite red flag. While the company is attempting to course-correct, the combination of executive shakeups and disappointing earnings suggests rough waters ahead. This isn’t financial advice, so do your own research (DYOR), but this latest news from Target definitely warrants a closer look.

Possible Google Searches After This 8-K From Target Corporation (TGT)

- Why are Target executives leaving?

- Target Q1 2025 earnings results

- What is Target’s “acceleration office”?

- Target stock forecast 2025

- Is Target stock a good buy now?

- Target sales decline 2025

- Impact of executive departures on Target

- Target digital sales growth

- Target revised guidance 2025

- Christina Hennington Target

- Amy Tu Target

- Target stock analysis after 8-K

- Target future outlook

- Target competitors’ performance

- Target long-term strategy

P.S. The SEC saga never ends! As Target Corporation files more, this analysis will evolve. Current as of May 22, 2025.